19 Mar 2018

by Kenneth Schortgen, The Daily Economist:

Throughout history gold more than any other commodity has held an intrinsic tie to sovereign currencies, and even much more than today’s oil based Petrodollar system. And you can see this of course in how gold’s purchasing power in a given currency has held its strength as said currencies themselves devalued over time.

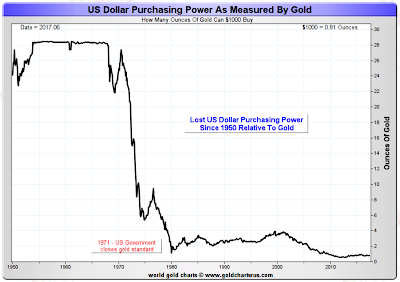

I use this chart because it brings up an interesting ratio. Ie… how many gold ounces could one purchase in 1960 just prior to the United States removing the currency from the Gold Standard (1964), and how many ounces could one purchase today for that same amount.

From 1960-65 you could purchase (if it were legal back then) around 29 ounces per $1000.

(Fast forward to today).

With the price of gold being around $1310 per ounce, this means that one could not even purchase a full ounce of gold for that same $1000. In fact the amount would be .763 ounces.

This means that the purchasing power in relation to gold has fallen 3800%.

So the questions that need to be asked are why is this important, and is there some reason why gold would ever revert back to its historic ratios?

The answers may lie in two things… the world rushing headlong towards a global currency reset, and an example in the nation of Venezuela that shows what happens when the government is forced to reprice gold.

Global Currency Reset:

A report released by the Nikkei Asian Review indicates that China is prepared to release a yuan-denominated oil futures contract that is convertible (backed by) physical gold. The contract will enable China’s largest oil suppliers to settle oil sales in yuan, rather than in dollars, and then convert the yuan into gold on exchanges in Hong Kong and Shanghai. This is a significant step in removing the global reserve currency status of the dollar and resetting the the global economic and geopolitical “landscape.” Over the past several years, China has quietly established yuan-based currency exchange facilities, which has set up the ability to implement this new non-dollar trade settlement financial instrument. According to the Brookings Institute, 34 Central Banks around the world have signed bilateral local currency swap agreements with the PBoC as of of the end of September 2016, including the major oil-producing countries. With this new contract, China’s largest oil suppliers will now be able to transact directly with China, and other oil importing countries, using yuan which are directly convertible into gold to settle the trade. – Investment Research Dynamics

Venezuela Reprices Gold 360,359%:

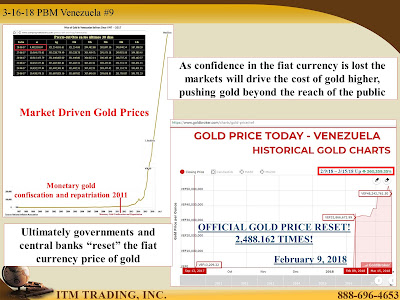

Chart courtesy of ITM Trading

What is it likely to look like when this global retirement crisis explodes? Venezuela gives us a peak. Drowning in unpayable debts, hyperinflation took off. First the market acknowledges gold as a store of value but ultimately, governments do too. The Venezuelan government prepared for the death of their currency and in 2011 Venezuela confiscated and repatriated monetary gold. They wanted to hide the hyperinflation that ensued, so they “managed” the spot gold price. Bankers and corporations knew better, and markets reflected that, but not the official price, that remained flat, until February 9th. On that day, “officially” gold in terms of bolivars, jumped over 2,488 times! This part of the “reset” is now in place. And that my friends, is how it is done. – ITM Trading

In the end the current status of over $250 trillion in global debt, over $1 quadrillion in derivatives, underfunded pensions, an insolvent Social Security system, bankrupt states, and an estimated $225 trillion in unfunded liabilities owed by the U.S. government will not sustain itself much longer. And when that system collapses, only a few choice items will be able to protect you when everything else is reset and devalued, and at the top of this list of course is that of gold.

Read more at original source: