21 Mar 2019

from DW.com:

As the yellow metal hits peak production, experts feel we may have discovered all of the world’s major gold deposits. So what does it mean for the precious metal aficionados and investors?

The murmurs that the world is running out of gold deposits have grown louder in the past two years.

Several experts and industry magnates, including Canadian miner Goldcorp’s chairman, Ian Telfer, have forecast a perpetual decline in gold production from its current peak.

Gold production reaching its peak levels is nothing new. The production of the yellow metal has reached its highest levels on at least four occasions in the past before witnessing sharp declines.

But many say there is something that makes the current gold peak stand out: There is simply no new major gold deposit left to be discovered.

“The largest and most prolific reserves have already been found,” Matthew Miller, an analyst at CFRA Research, told DW. “Gold miners are struggling to grow reserves in line with their production.”

Decadeslong decline

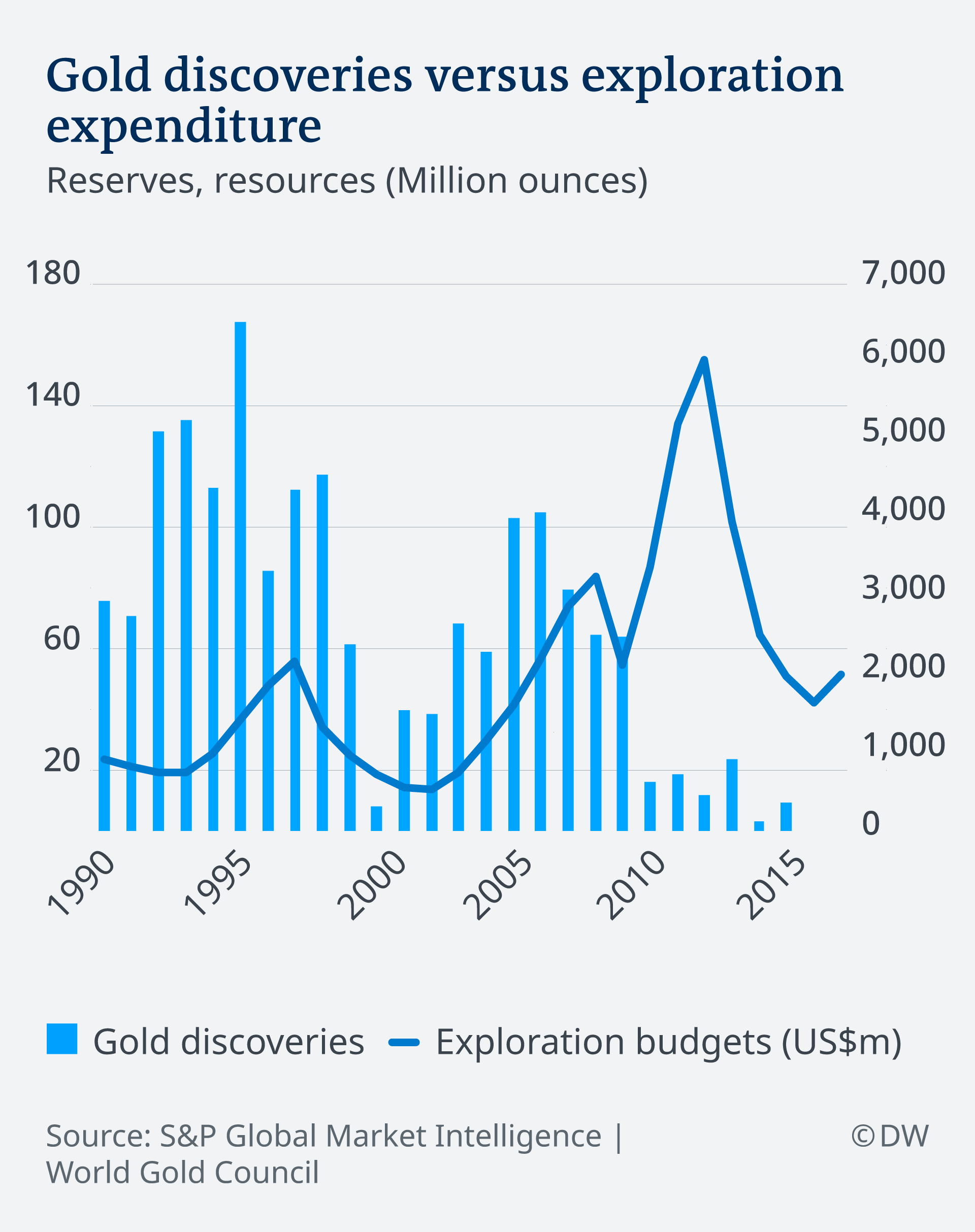

The rate of gold mine discoveries has declined over the past three decades, despite miners pumping more money into exploration, World Gold Council figures show.

Among the new discoveries, there have been hardly any that experts call “world class” deposits. These are typically large high-grade deposits with over 5 million ounces of gold reserves that can be turned into profitable mines capable of producing over 250,000 ounces of gold.

The prospective impact of a lack of “world class” discoveries on future gold production can be gauged from the fact that such mines account for nearly half of the global gold production today.

The average grade of the new gold deposits — the amount of gold that can be extracted per ton — has also been declining.

The average mine grade has fallen from over 10 gram per ton in the early 1970s to around 1.4 grams per ton today, according to Metals Focus, a precious metal consultancy.W

Spate of acquisition

The gold industry has been witnessing a wave of mergers over the past few months as producers battle poor returns and declining reserves.

Last week, the world’s largest gold miners, Barrick Gold and Newmont Mining, agreed to form a joint venture in a deal that canceled Barrick’s nearly $18 billion (€15.8 billion) unsolicited offer to buy Newmont. Earlier this year, Barrick completed the $6.1 billion acquisition of an Africa-focused miner, Randgold Resources, and Newmont agreed to buy smaller rival Goldcorp for $10 billion.

“The gold miners realize that the prices of companies are at such attractive levels that it’s cheaper to buy gold in the stock market than it is to go and explore for it,” John Ing, a mining analyst at Maison Placements Canada, told DW.

Laurentian Bank Securities analyst Ryan Hanley expects the consolidation to continue as companies look to refill their project pipelines.

“Given the lengthy amount of time required to explore, discover, delineate, permit, finance, and build a new mine, merger and acquisition is a much faster way to replace reserves,” he told DW.

The price factor

As gold reserves decline, companies have struggled to discover new deposits to replace the lost production.

Analysts blame low gold prices for the miners’ predicament while stressing that the world is not running out of gold.

“Finding gold is a function of the gold price,” said Ing. “There is no shortage of gold in the world but just at this price there is a shortage. It’s quite possible that gold will be $2,000 per ounce, you will see a rush of exploration and more deposits being found.”

Gold has been hovering around the psychological level of $1,300 an ounce since the beginning of this year — a far cry from the highs of $1,800 an ounce witnessed in 2011-12. Analysts estimate that a minimum price of $1,500 per ounce is needed to maintain current production levels.

The decline in gold prices has forced gold companies to cut costs with investors increasingly focusing on economic metrics like free cash flow generation as opposed to simply the number of gold ounces produced.

“This effectively marked an end to mining companies growing production at any cost and a heavier focus on economic ounces,” Hanley said.

Global exploration budgets for nonferrous metals have declined from a high of over $21 billion in 2012 to an estimated $10.1 billion in 2018. Nearly half of the exploration money last year is estimated to have been spent on gold projects.W

New frontiers

Analysts expect gold prices to rise in the longer term as gold mine supply struggles to expand. High prices and technological advancements are expected to push miners to explore new frontiers for the precious metal, including the seabed and possibly even asteroids.

Currently, Australia, Canada and the United States account for 40 percent of global spending on exploration.

“It’s fair to say that all low-hanging fruits have been plucked,” Ing said. “The miners will need to turn to countries such as Ecuador and some other places in Latin America or Africa, because places like Canada have been well picked over.”

Lure for gold

The expected decline in global mine supply in the longer term is not expected to have much impact on gold jewelry aficionados, the majority of whom are in China and India.

Gold supplied by mines is just a fraction of total available gold in the world. The world produces 3,000 tons of gold every year, while the amount of gold ever mined stands at around 190,000 tons, according to Metals Focus.

“In future most of the gold supply will come from recycling and not mining,” Miller said.

The World Gold Council expects the demand for gold in jewelry to increase over the next 30 years “in a richer, more middle-class, connected world.”

Read the original source here.